Key VA Loan Benefits for North Idaho Veterans

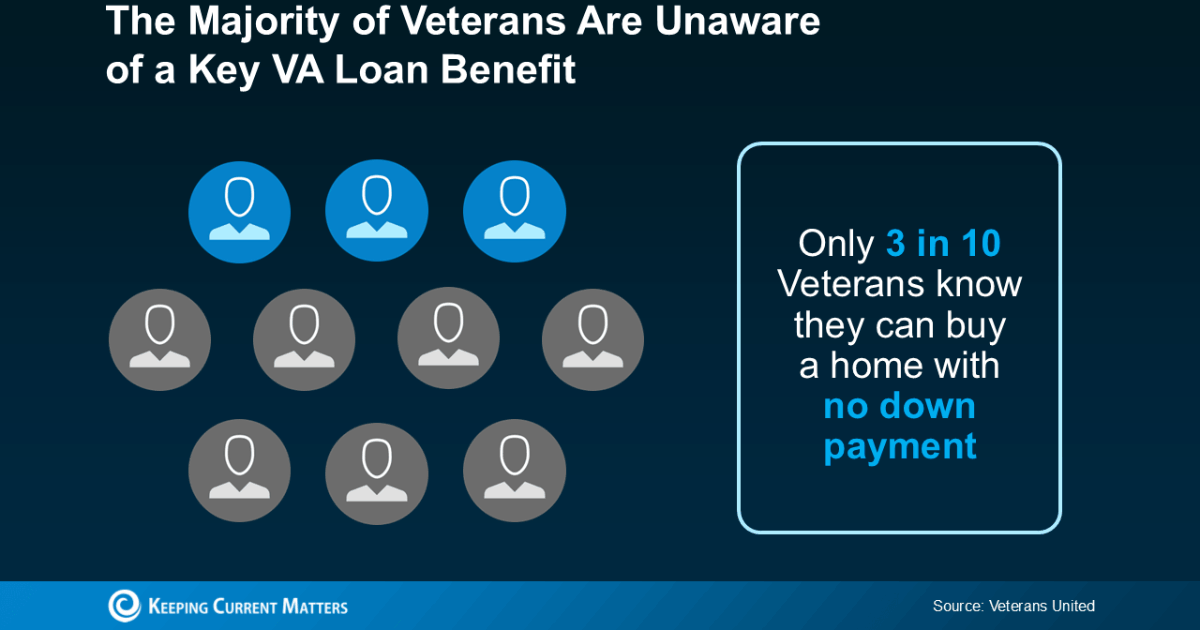

For over 79 years, the Veterans Affairs (VA) home loan program has enabled countless veterans to achieve homeownership, yet many are unaware of one of its most significant benefits. According to Veterans United, only 3 in 10 veterans realize they may be eligible to buy a home with no down payment required. This benefit can be particularly valuable for veterans in North Idaho, where home prices are rising but affordability remains a concern.

Why the VA Loan Benefit Matters for North Idaho

North Idaho’s popularity as a destination for retirees and veterans has grown significantly, thanks to its natural beauty, outdoor activities, and quality of life. However, the influx of out-of-state buyers has led to increased home prices in areas like Coeur d'Alene, Sandpoint, and Post Falls. For veterans and their families, a VA loan can be a game-changer in this competitive market, enabling them to purchase a home without waiting years to save for a down payment.

Key Advantages of VA Loans for North Idaho Veterans

VA home loans are designed specifically to help veterans become homeowners, with benefits that provide significant financial relief. Here are some of the major perks:

-

Zero Down Payment Options

Many veterans can buy a home with no down payment, which reduces the upfront cost of buying in North Idaho. Given the area's growing market and rising home prices, this benefit can be crucial for veterans looking to buy sooner rather than later. -

Limited Closing Costs

VA loans cap certain closing costs, reducing the amount of cash needed at closing. In North Idaho, where property taxes and closing costs can add up quickly, these savings allow veterans to keep more money in their pockets for other expenses. -

No Private Mortgage Insurance (PMI)

Unlike conventional loans, VA loans don’t require PMI, even if the borrower doesn’t put money down. This can lead to significant monthly savings, which is especially valuable in areas like North Idaho, where housing expenses are increasing. Lower monthly payments mean veterans can afford more house or save more each month.

Navigating the North Idaho Market with a VA Loan

In the competitive North Idaho housing market, using a VA loan can help veterans stand out, especially when working with experienced local real estate agents and lenders familiar with VA loans. Agents with VA loan experience can help veterans understand the requirements and processes specific to the program, ensuring they leverage all available benefits.

VA Loans and Community Benefits in North Idaho

The VA loan program doesn’t just benefit veterans—it also strengthens the North Idaho community by promoting stability and homeownership. By making it easier for veterans to settle and invest in homes, the program supports local economies and builds a stronger community fabric. North Idaho has a significant veteran population, and using VA loans to enable homeownership can create long-term positive effects, as more veterans choose to stay and thrive in the area.

Final Thoughts for Vets in North Idaho

Homeownership is a key component of the American Dream, and VA loans offer a powerful pathway for veterans to realize that dream. For veterans in North Idaho, this program provides an excellent opportunity to enter the housing market without a down payment, enjoy lower closing costs, and avoid monthly PMI costs. By working with a knowledgeable real estate professional and a lender experienced with VA loans, veterans can navigate the North Idaho market confidently and make the most of their hard-earned benefits.

North Idaho’s real estate market is vibrant and competitive, but the VA loan program can empower veterans to find a place they can call home in this beautiful region.

Categories

Recent Posts