This Week's Fed Meeting Impact on the North Idaho Real Estate Market

This week’s Federal Reserve meeting is drawing attention because the Fed’s decisions on the Federal Funds Rate indirectly impact mortgage rates and, by extension, the housing market. Although the Fed doesn’t set mortgage rates, its influence over borrowing costs, inflation, and employment shapes the broader financial environment, including North Idaho's real estate market.

How the Fed's Rate Decisions Influence Mortgage Rates and the Market

When the Fed adjusts the Federal Funds Rate, it affects the cost for banks to borrow from one another, which then ripples through the economy. As borrowing becomes more or less expensive, lenders adjust interest rates on consumer products, including mortgages. For North Idaho, where both buyers and sellers are sensitive to rate changes, these decisions are key. For example, as mortgage rates decrease, homes become more affordable, which can lead to increased buyer interest and competition in the market. If rates remain high or increase, however, buying power reduces, often slowing down market activity and stabilizing prices.

Key Economic Indicators the Fed Watches

The Fed bases its decisions on three core economic indicators: inflation, job growth, and unemployment rates. Here’s how each of these affects North Idaho’s housing market:

-

Inflation Trends

Inflation measures price changes for goods and services. To support sustainable economic growth, the Fed’s inflation target is around 2%. While inflation has dropped from recent highs, it remains slightly elevated. A continued decline could prompt the Fed to reduce the Federal Funds Rate, creating a favorable environment for lower mortgage rates. In North Idaho, lower mortgage rates could make housing more affordable for buyers, boosting market activity and price appreciation.

Fed Inflation Index -

Job Growth and the Economy

Job growth reflects economic health, but the Fed prefers it to moderate to avoid inflation spikes. Recent reports indicate U.S. job growth is slowing, which suggests a cooling labor market. For North Idaho, slower job growth across the country could mean that the Fed feels comfortable easing rates. Lower rates would allow prospective buyers to afford higher-priced homes, expanding the buyer pool. This would benefit sellers as well, as demand might increase. -

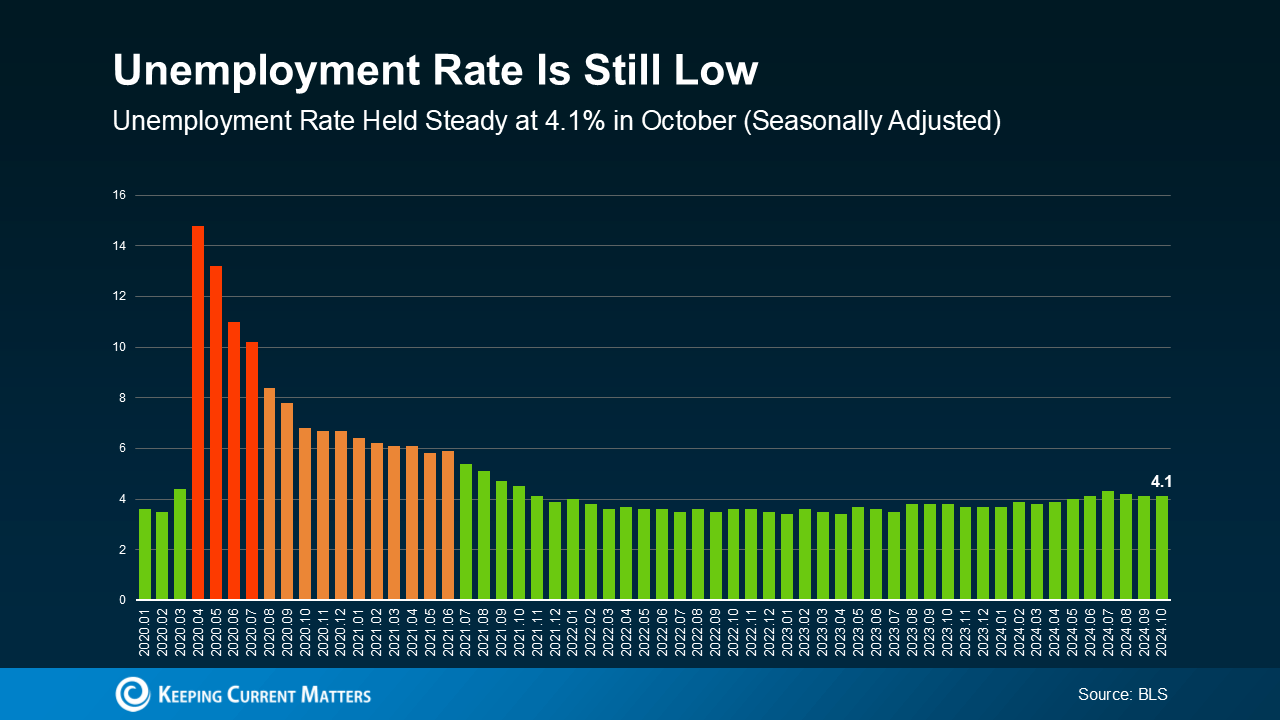

Unemployment Rates

Unemployment indicates the percentage of people actively seeking jobs but unable to find them. A low unemployment rate means a robust job market, which can boost consumer spending and drive inflation. With the unemployment rate currently around 4.1%, the Fed sees stability in employment, which gives them room to consider rate cuts. In North Idaho, stable employment, combined with easing mortgage rates, could increase demand for homes, giving sellers more leverage while providing buyers with the confidence that the local economy remains strong.

Implications for North Idaho’s Real Estate Market

For North Idaho buyers, any decline in mortgage rates could improve their purchasing power, potentially allowing them to afford homes that previously felt out of reach. This is particularly impactful for first-time buyers or those looking to invest in the region, where demand is high due to the scenic surroundings, quality of life, and influx of remote workers. On the other hand, sellers might see more competitive offers as lower rates open the market to a larger pool of buyers.

However, the Fed’s actions are only part of the picture. Mortgage rates may not immediately drop following a Federal Funds Rate cut; they typically decline gradually. Additionally, mortgage rate changes are influenced by various factors, including inflation projections, global economic trends, and market sentiment.

What’s Ahead?

Experts forecast that, as long as economic indicators like inflation and job growth continue trending favorably, the Fed will continue reducing the Federal Funds Rate incrementally. This gradual rate reduction suggests that North Idaho’s housing market could experience steady, rather than sharp, changes. As Ralph McLaughlin, a Senior Economist at Realtor.com, noted, the outlook for mortgage rates depends on labor market performance, political events, and potential inflationary pressures. For North Idaho buyers and sellers, this may mean preparing for potential rate fluctuations while anticipating overall rate stability by late 2024 or early 2025.

Final Thoughts for North Idaho

For North Idaho’s housing market, the Fed’s current economic direction could gradually bring some stability after a period of rate volatility. Both buyers and sellers should keep an eye on the Fed’s actions, especially as North Idaho’s popularity grows and demand remains high. Lower mortgage rates could present new opportunities for buyers and potentially spark more competitive listings in this highly desirable region.

Categories

Recent Posts